Tax Rebate Company Car Mileage – The Thai government’s Auto Taxation Refund system was launched in September 2011 and assisted many individuals receive their very first autos. Several zillion people signed up for that software throughout its marketing period of time. However, affected the budget of the government because it reduced tax revenues and car sales once the promotional policy ended the scheme. More, government entities had to deal with the on-going expenses of tax statements, which included in the cost burden. That is why, the auto Taxation Refund has stopped being supplied. Tax Rebate Company Car Mileage.

Needs for EVs

If you’re shopping for an electric vehicle, you may have heard about the potential car tax rebate for EVs. If you bought a qualified electric car, you may be eligible to receive up to $7,500 in tax credits. But what precisely qualifies for this particular rebate? You can get the entire list of eligible models at the US Department of Power web site. As a way to meet the requirements, your vehicle should satisfy numerous specific conditions.

When claims can vary, numerous provide benefits to encourage purchasing electric autos. Cal, for example, supplies a $4,000 taxation credit via 2021 for light-weight-task EVs, and Connecticut permits a $38 car tax refund for the vehicle. Moreover, other suggests have applied substitute gasoline technologies loans and mandates that federal government fleets use absolutely no-emission cars. And, as the rise in popularity of electric powered vehicles keeps growing, federal and state policymakers will work fast to expand the facilities of charging stations and also other bonuses for EV users.

Expiry particular date

You may be wondering when the expiration date for your car tax rebate will be if you own an electric or hybrid car. Even though the government is necessary to renew this software every year, lawmakers have the choice of reviving some provisions, such as the taxes rebate for electronic cars. The U.S. Division of Power listings entitled cars. However, you must file your tax form for the year that you purchased your vehicle.

Refundability

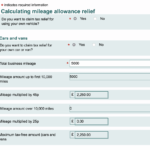

Lots of people wonder whether or not their car income tax refund is refundable, and the response is determined by which kind of motor vehicle you own. In most cases, a consumer can claim their rebate if they sold their vehicle within 45 days of purchasing another one. In other scenarios, however, a refund may not be accessible until many years later. It is important to know your car’s value before applying for one, to avoid a refund. You can use value of trade device to calculate just how much your car or truck is definitely worth. This info can significantly reduced the price tag on your following automobile.

Together with paying for a brand new motor vehicle, a taxes return can assist you with some other expenditures maybe you have for your personal motor vehicle. If you purchase a new vehicle, you may use your tax refund for GAP coverage, if you are purchasing the vehicle brand new, for instance. You may need to purchase auto insurance if you are buying a pre-owned car. A new vehicle insurance policy costs dollars, and you may use your income tax return to fund that at the same time.