Ri Rebate For Buying Hybrid Car – If you own a plug-in hybrid vehicle, then you might qualify for the Hybrid Car Rebate. However, this incentive is not valid for pure electric vehicles. This article will deal with the basic principles of whether you be eligible for a the rebate and how to sign up for it. Continue reading to understand more about this motivation. Fascinated? Get moving by reading this report! Until then, take pleasure in the cost savings! And don’t forget about to leverage the benefits while they’re still accessible! Ri Rebate For Buying Hybrid Car.

Connect-in hybrids be eligible for the Crossbreed Car Refund

You should look into rebate programs if you’re considering a new electric car. Numerous states and also some metropolitan areas offer some kind of motivation. These bonuses will come by means of a taxes credit or refund. Be sure to look at the state’s site to learn more. You may qualify for a Hybrid Car Rebate if you live in California. These rewards can help you save lots of money. And by driving a power vehicle, you happen to be adding to a solution setting, and also to community overall health. Along with income incentives, plug-in hybrids also qualify for the California Electric powered Vehicle Refund.

The federal government is reworking its credit score for connect-in hybrids and electric cars. They already have lately elevated the limit to 200,000 for every single kind, such as Tesla. The stage-out period implies that an automobile obtained next time will never be eligible for a the taxation credit rating. For now, an individual may declare 50Per cent in the credit history for the first two quarters, and 25Per cent in the credit history is going to be applied to their income tax accountability the following 12 months.

100 % pure electric powered cars don’t be entitled to the Crossbreed Car Rebate

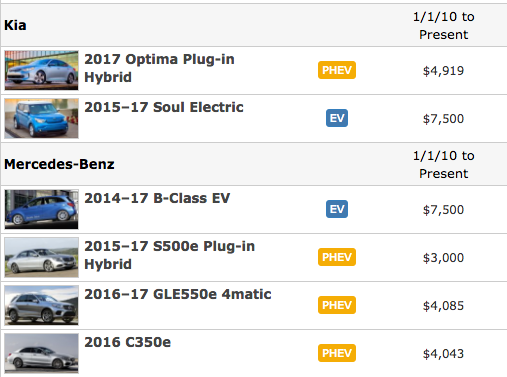

The Crossbreed Car Refund is just not reasonable for pure electrical cars, as the national list for qualifying automobiles doesn’t involve them. To be eligible for a the credit score, a power motor vehicle have to satisfy many criteria. It needs to be a crossbreed, or have got a battery power package that may be 4 kWh or increased, and become rechargeable by an external resource. The government delivers a credit of $2,500 for battery power-electric autos and $417 for vehicles with several kWh or higher.

Depending on the battery size, the standard 2021 Toyota Prius does not qualify for the Hybrid Car Rebate, but the Prius Prime plug-in vehicle does. The Prius Excellent plug-in motor vehicle may be recharged by an external power source and is eligible for the $2,500 taxation credit. The 2021 Toyota RAV4 Perfect plug-in hybrid features a greater 18.1-kWh battery power and it is qualified to receive the total $7,500 taxation credit score.

If you be entitled to the Hybrid Automobile Refund

If you’re wondering if you qualify for the Hybrid Car Rebates, you may be surprised to learn that you can get up to $7,500 in tax credits for your new vehicle. The amount of the credit history is dependent upon battery dimension, meaning a fully electrical motor vehicle can assert a bigger volume of credit history than the usual plug-in crossbreed. Even if this credit score is a terrific way to obtain a tax crack in your new vehicle, you can’t depend on it to cover the whole car.

Initial, you need to discover which vehicle designs be eligible for a the Push Nice and clean Rebate. The most popular hybrids are not eligible, though there are many different car models that qualify for this credit. Individuals cars range from the Ford Fusion and Milan Hybrids, the Honda Knowledge and Accord hybrids, the Toyota RAV4 Crossbreed, and also the Toyota Camry Crossbreed. It’s also really worth remembering that the plug-in hybrid Toyota Prius Connect-in is not going to qualify for the credit history.

How to apply for the Hybrid Auto Rebate

If you’ve recently purchased a new hybrid or electric car, you might be wondering, “How do I apply for a Hybrid Car Rebate? ” The good news is that you can. In Maine, you may apply for a federal government income tax credit score by buying a brand new plug-in electronic motor vehicle. To make use of, you need to initial go to a contributing dealer and submit a refund develop inside of 45 times of purchase.

In Ca, the Plug-In Crossbreed Prize software offers you a $750 cash refund on your new motor vehicle. The refund is in addition to a national income tax credit score, so that you can save as much as $8,000! The total amount you can be entitled to depends on the size of your electric battery. For more information about California’s bonus plan, have a look at Plug In United states and also the U.S. Section of Vitality.