Do You Get A Rebate On Hybrid Cars In Maryland – You might qualify for the Hybrid Car Rebate if you own a plug-in hybrid vehicle. This incentive is not valid for pure electric vehicles, however. This article will cover the basics of no matter if you be eligible for the refund and how to sign up for it. Continue reading to learn more about this motivator. Curious? Get moving by looking at this article! For the time being, take pleasure in the savings! And don’t neglect to make use of the bonuses when they’re still offered! Do You Get A Rebate On Hybrid Cars In Maryland.

Connect-in hybrids be eligible for a the Crossbreed Automobile Refund

You should look into rebate programs if you’re considering a new electric car. A lot of says and in many cases some towns offer you some kind of motivator. These incentives comes by means of a taxation credit history or refund. Be sure you examine your state’s internet site to learn more. If you live in California, you may qualify for a Hybrid Car Rebate. These bonuses can help you save thousands of dollars. And also by driving a car a power automobile, you will be contributing to a more clean environment, and also to community well being. Together with funds discounts, connect-in hybrids also be eligible for a the Cal Electronic Motor vehicle Rebate.

The government has been reworking its credit for plug-in hybrids and electronic automobiles. They may have fairly recently greater the limit to 200,000 for each variety, such as Tesla. The stage-out time implies that a car purchased next time will not likely be entitled to the taxation credit rating. For now, a person can declare 50Per cent in the credit for the initial two quarters, and 25Per cent of the credit history will probably be placed on their taxes liability the subsequent year.

Pure electric powered automobiles don’t be eligible for a the Hybrid Auto Rebate

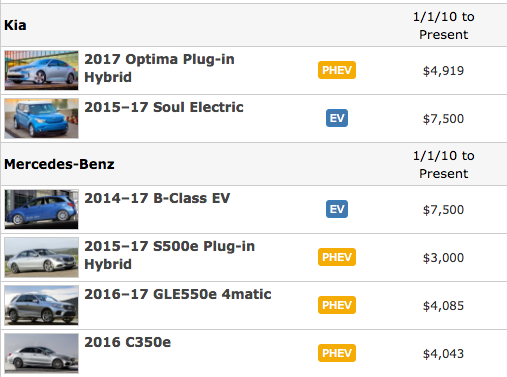

The Hybrid Car Rebate will not be legitimate for 100 % pure electrical vehicles, as the federal government checklist for being approved cars doesn’t consist of them. To be entitled to the credit history, an electric powered motor vehicle need to fulfill numerous standards. It needs to be a crossbreed, or possess a electric battery package that is 4 kWh or better, and stay rechargeable by an external provider. The federal government offers a credit history of $2,500 for battery-electrical vehicles and $417 for automobiles with 5 kWh or more.

The Prius Prime plug-in vehicle does, although depending on the battery size, the standard 2021 Toyota Prius does not qualify for the Hybrid Car Rebate. The Prius Excellent connect-in car can be recharged by another source of energy and qualifies for that $2,500 taxation credit score. The 2021 Toyota RAV4 Excellent connect-in hybrid has a bigger 18.1-kWh battery power which is qualified for the full $7,500 income tax credit.

Should you be eligible for a the Crossbreed Vehicle Rebate

You may be surprised to learn that you can get up to $7,500 in tax credits for your new vehicle, if you’re wondering if you qualify for the Hybrid Car Rebates. The volume of the credit rating is dependent upon the battery sizing, meaning that an entirely electric automobile can state a larger amount of credit score than the usual connect-in crossbreed. Although this credit history is a wonderful way to get yourself a taxes crack on the new motor vehicle, you can’t count on it to pay for the entire auto.

First, you have to find out which car models be eligible for the Travel Thoroughly clean Refund. The most popular hybrids are not eligible, though there are many different car models that qualify for this credit. Those automobiles include the Ford Combination and Milan Hybrids, the Honda Insight and Accord hybrids, the Toyota RAV4 Hybrid, as well as the Toyota Camry Hybrid. It’s also really worth noting that the connect-in crossbreed Toyota Prius Connect-in will not be eligible for the credit history.

How to get the Hybrid Car Rebate

If you’ve recently purchased a new hybrid or electric car, you might be wondering, “How do I apply for a Hybrid Car Rebate? You can. That is ” The good news. In Maine, it is possible to make application for a national taxation credit score by purchasing a fresh plug-in electrical automobile. To use, you must very first go to a taking part dealer and send a refund kind inside 45 events of purchase.

In Cal, the Plug-In Crossbreed Compensate system offers you a $750 funds refund in your new motor vehicle. The refund is along with a federal tax credit history, in order to help save around $8,000! The quantity you can be eligible for a depends upon how big your electric battery. For more information about California’s motivation system, look at Plug In The usa and also the You.S. Section of Vitality.